All about the Nairobi Stock Exchange, USE, DSE, LUSE, GSE, FTSE & KENYA. (Please see disclaimer at the bottom of the page)

Monday, November 30, 2009

Happy Jamhuri, Xmas & New Year

Monday, November 23, 2009

Is money-making and Godliness compatable?

Tuesday, November 10, 2009

The "too big, please don't fail" banks in Kenya

- KCB: At close of play in September 2009, KCB had a balance sheet of Ksh189bn, which si roughly speaking 27% of Kenya's total budget. It also has around 200 branches, 150 of those in Kenya. Thus its a large employer as well. Its collapse won't be pretty. Remedy: At 13%, its tier 1 capital ratio looks strong for versus some Western banks, but its target should be 20% or more given its host economy.

- Equity: Holds just under 50% of Kenya's banking account population irrespective of the size of their accounts. And has 155 branches (130 of them in Kenya). Its collapse would lead to a severe dislocation SMEs and agriculture for which it serves a significant portion. I see its risk coming from liquidity rather than capital concerns. Remedy: Should be required to hold at least 12% of its assets in form of t-bills and or AAA-rated gilts.

- BBK: At Ksh170bn (June 2009), its also a behemoth in the local economy. Included here because of its corporate client content which would again cripple our economy were it or the parent to collapse. Remedy: As with KCB, probably more suspect to lower capital thresholds and should thus be required to hold at least 15% tier 1 capital ratio at all times.

- Co-op: The banker of co-operative societies and Saccos country-wide. And like Equity, therefore, carries systemic risk for the economy. Has a history of appalling size of bad loans coupled with political inteference. Remedy: Higher liquidity and capital requirements. The broker licence was probably a mistake.

Monday, November 09, 2009

Investment banks should be banned from proprietary trading

- A1 who is the broker. She executes buy and sell orders on behalf of Angukia's clients (corporate, high net worthy and raia).

- B1 is Angukia's proprietary trader. He buys and sells various instruments using Angukia's capital.

- Finally C1 is the investment banker. He advises Angukia's corporate clients on mergers, divestitures, acquisitions, financing and capital raising events (such as rights issues).

Tuesday, October 27, 2009

Warren Buffet: invest in what u know & other priceless gems

Thursday, October 22, 2009

Living abroad and investing

Wednesday, October 21, 2009

Does universal banking have a future in Kenya?

Thursday, October 15, 2009

Insurance as an investment/saving product

Thursday, October 08, 2009

Giving NSE some bouyancy

- Brokers' embezzlements

- Economy messed up by (a) PEV (b) drought (c) bloated GoK (d) public crowding out private sector

- 2012 and bleak outlook

- Bonds taking up the liquidity

- et al

- Share consolidation: while (i) sharebuy back legal stuff is being sorted out and in any case will probably be too expensive in the medium for any firm to contemplate doing (ii)the cheaper share consolidation is easy to do and will give shareholders, brokers and the firms themselves a consolidated cheaper way of managing the quantity of shares. Safaricom being the share that indirectly started the current bear should kick-off the stage by doing a 10 for 1 share consolidation. This would mean 40 shares if you currently hold 400 and so forth. Equity could then do a 2 for 1.

- Shorting: a hobby horse of mine where the NSE is concerned. It will probably be the single most educative instrument that can be introduced to the NSE. Because it allows an investor to make returns and take a view whether a share is rising or falling, NSE investors will no longer think of shares as endlessly rising investing instruments. Clearly, brokers will also have two more avenues for revenue generation. How about concerns re margins?Initially, the movement when shorting could be limited to a 20% loss at which point the investor would have to come up with the cash to cover his losses.

- Bring up NSSF: UK obviously banned NSSF from new share purchase to facilitate liquidity in the bond market. In the medium and longer term however, its a silly policy to ban one of the deepest pockets in the land from a capital market. An oxymoron if you like.

Wednesday, October 07, 2009

What type of CBK governor does Kenya need?

- Control money supply

- Prudential supervision of the banking/financial system

- Patron governors: These are in effect there to support the economic policies of the government of the day. So they'll adopt monetary policy and in some cases, supervisory policy to the govt's economic policies. As an example, in the US we had Greenspan who in support of credit-based economic growth adopted loose banking regulation (even going along witht the idea of awarding self-regulation to some of the larger ibs). In Kenya, we had men like Kortut who was very supportive of the export intiatives that Pattni had come up with or even Mullei who was able to relax the reserve ratio in 2003 so that banks could lend more. In Nigeria, Chukwuma Soludo presided over the introduction of margin lending which indirectly has brought the Nigerian banking system to needing bail-out.

- Clean-up governors: Patron governors with a few exceptions, always create a mess. Guaranteed. Because their policies are not rooted in the basic functions of a central bank, these types of governors wonder into unfamiliar territory which (a) they don't understand (b) can't not then control. Greenspan was talking about cleaning up the mess created by "irrational exburance", but he really didn't know or understand what he was talking about since the scale of the bailout has been huge. Clean up governors therefore have a thankless task of undoing the work of patron governors. Cheserem did this in Kenya in the mid 90s.

- Independent governors: In effect perform the function of a central bank and are thus usually quite unpopular only surviving due to a change of government. Mervyn King has done this to a certain extent. In Kenya, we are yet to see one but urgently need one.

Tuesday, October 06, 2009

Agriculture food exchange

As this FT article shows, agriculture exchange would resolve two problems that have hampered farmers from growing their farming as a business:

1. Pricing: many farmers especially those dealing in perishable horticulture produce typically rely on rumours on what prices are. An exchange close to home will be able to relay the information much more cheaply

2. Transport: never mind the roads, due to (a) lack of enough cars (b) fuel costs; farmers typically have to shoulder the costs wrought by these two factors thus minimising their returns.

Friday, October 02, 2009

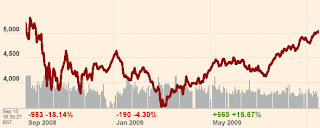

Stockmarkets retrace on the way

After 6 months of almost uninterrupted rise driven by a huge sigh of relief at surviving the largest financial crisis since the South Sea bubble, we may have a retrace shortly. A rise of 60% seems overdone given rising unemployment; budget deficits which suggest that while the economies are recovering, the recovery is not going to be anywhere as fast or as strong as the markets have factored. I therefore expect markets to fall by around 10% in the coming fortnight but thereafter start a slower upward movement as financials start reporting in early November.

Thursday, October 01, 2009

Thinking of having kids?

Monday, September 28, 2009

The KenGen Ksh15bn bond beneficiaries

- Retail investors:- despite a drop in inflation, its unlikely that it'll go below double figures before 2012. That means that in real terms, a retail investor will be making a loss from investing a Ksh100k of his in the bond. Although its unusual in Kenya, you may not be able to get the full principal in the first 2 years. It'll be 2017 before you double your money.

- High net worthy: If you have Ksh5m and the risk-aversion of a typical elderly investor, then the 12% is sound return. However, NSe shares pay over 10% in dividend alone.

- Money market fund managers: will love this bond because it make them very competitive against savings accounts.

- KenGen shareholders: interest payment of just over a Ksh1bn will hit the P&L every year. In the first few years, there will be no concomitant revenue from the project to offset this. Something to ponder?

- Electricity consumers: should hopefully see fewer rationing episodes.

Living abroad: When in Rome...?

- we like our drink and driving. In most of the western countries, this is a huge no no and is a deportable offence. I've lost count

- The law is the law. Lots of black and white situations (i.e. no room for your interpretation) across the bureaucracy.

- Lack of papers means many of us do a lot of underground/menial jobs with no bank accounts and the like.

- Strong motherland bias in investing.

- Loneliness- no weekend relas or easygoing friends...Race is an issue

- Living costs are 4 times higher than Nai in some cities abroad

- Family life is not easy. No mboch or you get expensive childcare. Discipline your kids at your own risk.

- Relas in the motherland expect instant returns adding to the stress.

- Failure to appreciate social situations especially awkward pc ones.

- A significant proportion of our students never complete because of economic situations-note that in some countries students are only allowed to work for given number of hours e.g. 16 per week in the UK.

- Cramped or unhealthy accommodation.

- and the worst, getting ripped off by relas when you entrust them to look after your ventures in the motherland.

- And expecting the law to be on your side in the motherland...

- If you are a prospective student, think not about what your mate is doing but what is your calling. That way, you will be able to endure.

- If you are a student, aim high because lecturers and tutors can be your best reference for jobs in your study nation. Some countries are now giving students 1 yr job visas. Its an awesome situation to make yourself indispensable to your employer.

- If there is a job opening, stay out of office politics, pray your boss gives you the portfolio your qualification deserves and work hard like a Kenyan. You'll shine.

- If you are here for a visit/a few £s, learn what can jobs pay with minimum farce and supervision.

- The west is an individualistic society. Take the opportunity to build and discover you.

- If you can get married and appreciate the cost and difficulties of bringing up your kids here, do so especially if you are a guy. Otherwise, the pubs are waiting to drink your sweat.

Monday, September 21, 2009

KACC: Prevent, Convict & Recover Assets vs Corruption

While many have focused on the kibz illegality (in spirit and law) in re-appointing Ringera, we've overlooked the criteria by which we should evaluate his tenure and KACC's in general. On this criteria, KACC either be closed or revamped as something completely different. Summarising KACC's functions leaves with3 core ones against which you can evaluate its success

- Prevention: by educating; campaigns; facilitating whistleblowing; following up and taking forward credible complaints of corruption. And probably the easiest, using the public wealth declaration forms to pursue GoK employees. Corruption is far worse now than it was in 2003 when KACC came into being. I know and I'm sure others know many who went to parliament in 2002 as paupers and are fabulously rich today. Murungaru is an example. He was facing an auction in October 2002, but today he is... So where is KACC?

- Convicting of the corrupt: This is more the role of the Ag and DPP, but do note that KACC has to present fool-proof evidence of corruption. Crucially, note that KACC can institute civil proceedings where it has evidence that taxpayers money has gone missing via corrupt actions. On either fronts, it has not done so. Even it has presented evidence, I believe only Margaret Gachara has ever been convicted of corruption and even in her case, KACC never went ahead to recover assets.

- Recover of Assets: Biggest failure in my books. From Goldenberg, Ndung'u commission, Anglo-Leasing there has been evidence that taxpayers money was diverted to private pockets. I believe Ksh78bn was mentioned for Goldenberg alone. Ksh4bn that it has recovered is probably what KACC has spent since 2003.

On the above criteria, its fairly obvious that KACC has failed and we need to move on...

Wednesday, September 16, 2009

NSE: where is hope?

Tuesday, September 15, 2009

It was a u/v curve

Today 1 year ago was a fairly traumatic day not least for Lehman Brothers folk who turned up to work only to be told no pay no job et al. While there is generally little sympathy for big bank-bursting bonus earning folk getting made redundant, the effects were felt world-wide and are of course still reverberating today with many unit trusts and hedge funds who had or offered clients exposure to Lehman Brothers' structured products suffering.

Tuesday, September 08, 2009

Aligning bank's size to the economy

After you've

- set required capital ratios

- asked banks to holds capital against every balance sheet

- hold the right type of capital- unencumbered permanent share capital

- request a "will"

- request banks' single counterparty exposure be limited to a multiple of capital

You still won't have tackled the largest elephant in the room so to speak. That is banks that are so large that you don't want them to fail because the cost of rescuing is too prohibitive. Socially, financially, economically locally and maybe even globally, these banks become a threat with economies of scale outweighed by externalities.

Thursday, September 03, 2009

Kenya's population growth: time for the China solution?

We are poor nation in money terms.

- Kenya's population stands at around 40mn having doubled over the last 25 years.

- It’s growing at 2% per year which means it is on schedule to double in 2050.

- In real terms, our GDP has stood still since 1995 in real terms (that is 2002-2006 was merely to get us on even keel with 1997 and before and years since have been eroded by double-digit inflation). The economy as its structured currently can't double in that period.

- 65% of our population ekes a living from agriculture. Though this percentage will decrease in term, the total rural population will still account for around 50% by 2050

- Only 8% of Kenya's land is arable

- Without a sharp reversal, the current environmental degradation coupled with land issues, may well reduce this proportion of arable land to around 6%.

China was faced with similar circumstances in early 70s, its population having doubled within a period of 30years and with a static economy and agriculture growth. It worked what was its optimal carrying capacity based on its ability to feed its people (given arable land, land and economy growth potential) and instituted what is today known as the "one-child". It was actually more nuanced than that i.e. the one-child policy only applied to urban cities and didn't explicitly preclude having more than one child.

Is the population control needed for Kenya? Well, going above, a definitive yes. Is a China-type policy practical? Yes, GoK would offer to educate one child for free all the way to secondary school provided the parent/s only had the one. The parents would then have to pay for any additional ones.

Credit where its due: Kenya High Comm (UK)

At the Kenya High Commission in the UK, I believe as a Kenyan that you can experience how good Kenyan civil servants can be at delivering. A new passport application will typically take around 5 weeks. There is actually faster that it'd to get a British passport, but is also a smoother process. That is, you go online and print out the application form, you're told what other documents you need; how much it'll cost you and which mode of payment is acceptable. If you submit at their office, you'll get the option of the new passport being posted back to you or you get a phone call when it is ready to pick up and you just go there between 2-330pm. And that’s that. While at the London office, you'll get a pick of glossy magazines such one from Magical Kenya. I usually take away copy and give to colleagues and one or two have booked safari tours on that basis. A word though about the Kisumu2007 glossy. On the face of it, it has the GoK emblem, but has clearly been done by some of those NGOs to justify their extravagant lifestyles in Kenya. Some quotes "the Nai to Kcity road is a good example of the many complaints about neglect of roads in certain areas". And they are trying to market Kisumu!

The High Comm has also involved itself with nrks in the UK to a very high degree, attending most events that with a Kenyan theme. Unusually, its website is updated regularly.

All in all, Kenya High Comm gets my vote for civil servants we can be proud of.

Thursday, August 27, 2009

Breaking news: NSE Brokers release financial results

Kudos Stella, these are two steps forward. Next thing is to introduce a uniform financial proforma. 4 lines of income (brokerage fees, advisory, profits/gains on investments and other); 4 lines of expenses (staff, admin, financial cost and other), capital and cash flow statements.

Wednesday, August 26, 2009

Loss-making brokers? Need to get real

It must be for incompetency that stockbrokers have not been as profitable as banks in Kenya. Stockbrokers get Ksh2 for every Ksh100 transacted. Doesn't sound much. The total NSE' valuation was around Ksh1trn or just over that during the bubble period that peaked in last August (in transaction value terms). However only a fraction of that (infact around 10% at its highest) is ever transacted (bought and sold) in any given month. The monthly average transaction is under Ksh2bn. Thus 18 brokers (and shrinking) get to share Ksh20m in commission. And its not an equal cake hence some won't get even the Ksh20mn. However, even when you assume that each of the 20 employees (on average) gets Ksh0.5m per month, additional costs won't come to Ksh10mn per month. Therefore, with a few exceptions, its difficult to understand why the brokers have the issues they've had with profitability.

a) they can change the transaction charge structure so that each broker can charge as they wish, but also complete on service level and variety of distribution channels (including the cheap internet option).

b) either focus on volumes or transaction size, but this is already a target market by the likes of D&B, Kestrel Capital and SIB who rely on big clients making big transactions.

c) chase after the illusive ib trade of which there are already some ibs that get the choice business.

d) throw themselves at the mercy of the big deep pocketed banks.

Monday, August 10, 2009

Profetha, banks are not lending because...

A bank borrows from A and lends to B. The borrowing bit is called deposits and the lending bit is called loans. If it borrows from the raia, a bank rarely pays anything to borrow this cash, but will charge the same raia a considerable premium for lending to him/her. If it has borrow from other banks or other companies, it may have to pay something for the deposits. It can also borrow from the CBK, but its not called lender of the last resort for nothing. It'll sometimes demand explanations or a premium.

Simple maths will tell you that it makes a higher margin if it can borrow from the raia. Even more if it can lend back the same to that raia or his/er ilk.

Alas, we have times of plenty and times of scarcity. In times of scarcity, the bank can't borrow from the raia. It thus needs to pay to more to entice another raia or other entities to part with their cash. The other side of the equation is that the broke raia doesn't keep his/er loan repayments. The bank discovers things are thick. It decides that'll only lend to the select few who ordinarily don't to borrow anyway.

CBK wakes up and realises things are not well and its whole system is afire. Reducing the rates it charges as lender of last resort has no impact.

Professor that is where things are. Economy has no electricity to power businesses or consumers. Basic necessities are now luxuries such as flowing water and even food in some cases. It'd make more sense to have a word with the man up the hill...

Wednesday, August 05, 2009

Results Catch Up- NSE FTSE half yr

Friday, July 31, 2009

Mau squaters shouldn't get compensation

Thursday, July 30, 2009

Be part of "Enough is enough"

So rather than whining about lack of water, this is a good opportunity to go and do something about helping ensure supply returns next year. Was reading an article about how Kagame pioneered such a scheme successfully in Rwanda and it has helped reclaim wetlands.

Wednesday, July 29, 2009

BRIC nations to provide us with the next bubble

Ever since the credit crunch crunched its way thru investor holdings, many have gone thru

(a) initial state of denial

(b) a renewed determination to avoid equities as an investment vehicle

(c) a reality check as interest rates touched decade lows

d) tentative search for alpha in other markets and initial tentative steps

(e) current deluge of funds flowing into the BRIC countries on hope that their economies will really motor over the next 2/3 years while they await return to normalcy in the US and western economies.

Result-taking China as the prime example? The Shanghai Indices and the proxy Hand Seng have all doubled in value since last September.

So how does that equate to a bubble scenario? Well, the rise is too sudden and when you think that China's main trading partners are US and Japan, is probably not supported by fundamentals. Finally, the monetary/fiscal side of the equation has weighed heavily in favour of a liquidity overhang in the economy.

The other BRIC nations have also seen first snap backs in equity market due to commodity price rise. Are the price rises sustainable?

Monday, July 27, 2009

Investing with 2012 in mind

Saturday, July 25, 2009

KDN's Solar Energy

Capitalism- in the real world. Making it work for Kenya/Africa

Even without ever have met me, I'm sure you would not imagine that I'm the sort of fella who ever give Usain Bolt a run for his money. So just think of a situation where I was told that from now hence-forth I'd have to earn a living by competing against the likes of Usain!

That in a nutshell is what free market adherents and their neo-con friends believe economies around the world should use as their operating theory and model.

I like what capitalism can do for economies and society at large.

My worry is that many including the majority of its cheerleaders don't understand capitalism.

Capitalism = arbitrage. As long as an individual, a firm a country is able offer a distinctive

- product

- service

- skill

- experience

and do so at a mark up to cost with people willingly paying, a profit will be made.

The two key words are distinctive and able. Going back to the running example, the distinctive offering is a skill to able to outrun a cheetah. I don't have, so what happens to me. Secondly, I may have the distinctive advantage of being to run that fast , but how'd reach the pinnacle of my career if I am located in Mathira?

The obvious point is that capitalism can only work if it has strong institutions to backfill all the gaps that exist in terms of people who don't distinctive something or the ability have vis a vis others in the same society.

In Africa especially, its vitally important to recognise the role that private sector can play in transforming industries and therefore economies, but be prepared to mid-wife those industries and societies until they are in a position to be able to compete.

Wednesday, July 22, 2009

The coming campaign money tsunami

My baseline guest-estimates is that between last year when the grand collision came into effect and mid 2011, PNU and ODM will each have raised Ksh2bn+ in preparation for 2012. The main ways this will be;

1. Kickbacks on large projects and especially roads building. Note this doesn’t have to be done upfront merely inflation of costs.

2. Obscure and uncontrolled projects such as those aimed at liberating Vijana and Wanawake from poverty. With fairly undefined rules.

3. Financial pledges for services rendered. Catch all but includes business connections abroad and at home

4.

Monday, July 20, 2009

US and Kenyan Ibanks/Brokers

The only major difference is that the US ibanks and brokers are for most part listed entities. Otherwise the similarities abound:

- · Deal-making: primarily done on connection basis. Its only in the US where the govt could create a system like thru TARF and then get the ibanks to advise , consult and run most of it. GS gets a lot of international type of business because it places its alumni into positions of influence in the US govt. In Kenya, D&B pretty much has gotten all the Kibz era GoK IPOs/OFS. It’s no coincidence since Jimnah cultivated the NARC assiduously and still has close connections with the mishmash GoK

- · Regulatory capture: Regulatory capture is a fancy term for when industry regulators become the dogs that are wagged by the tails they are meant to regulate. Ibanks and brokers set the pace for the regulators in both countries. In good times, ibanks and brokers come up with fancy products and ways of doing things and then ask regulators to regulate them or rivals out of compe. A classic- pal who works with an ibank tells me that in 2007 he approached his his firm’s regulator to get clarification on how the regulator wanted his firm to calculate regulatory capital to be set aside for his firm’s credit default swap business. The regulatory had no clue. Apparently, reporting requirements on SIVs and SPVs were to start this year! At the NSE, CMA has been used to keep compe in or out of the NSE. BBK’s application to list a bond in 2003/4 was refused but agreed to last year when NSE needed the business. Look at the tied agent system being introduced. Its retrogressive in that most countries no longer use it. Its meant to keep out compe given the product is only one-Access to shares at the NSE-

- · No boundaries between business and politics: NSE has remained a protected enclave despite the scandals et al because of its symbiotic relationship with the GoK of the day. Even in the 80s when no Kikuyu business was immune from m-o-1’s pruning ways, the NSE remained intact and reached its highs in the early 90s. Two or three CEos of ibanks/brokers have actually stood as MPs. Eerily, most of the big changes have taken place in an otherwise very friendly environment. Expect this to continue. In the US, it is absolutely no coincidence that Hank Poulson oversaw the decapitation of 3 of the top 5 ibanks during his short stint’s as Treasury Secretary. Goldmans Caschs got $12bn from AIG’s rescue and is the main beneficiary of the demise of its 3 rivals especially in fixed income. Hank Poulson is immediate former CEO...@ Goldman Sachs.

Wednesday, July 15, 2009

Institutions, institutions, instutitions

Thursday, July 09, 2009

Short selling shares at the NSE

Since the NSE is afraid of introducing market-makers to provide a bit more liquidity into the bourse, and brokers are broke, why not allow shorting of shares formally?

I figure looking at some of the past trade patterns that this already happens anyway. Kichini chini, Kenya-style.

Briefly, short selling works like this. I go to JM and borrow 1m HFCK shares paying him Ksh1 per share as borrowing fee. We agree I'll return them in 4 weeks time. I then sell them immediately say at Ksh17.50 per share. I sit back having (a) surmised that my trade won't go unnoticed or (b) had some inkling that HFCK was due release some nasty news. And buy back the shares at Ksh15. I give JM his shares back. JM makes a Ksh1m and I make something similar.

It would be a winner for all.

- Brokers-would get their usual commission per transaction.

- Long-term investors get to earn something while awaiting their horizon to mature.

- Bourse has increased activity and interest.

- Short-term investors get interested in the market.

- Even lawyers get a bit of the crust in creating and signing off contracts although in most occasions the broker can facilitate.

So where is the problem? Are Kenyans only ever to be interested in the NSE when we have an IPO or a bull run?

Tuesday, July 07, 2009

The journey of life

Monday, July 06, 2009

NSE sectors stock pick for July and the 2nd half of 2009

Agriculture sector: Tea companies will benefit from current dry spells in pretty much every South Asia country especially India and Sri Lank (Kenya's tea rivals). Primarily, will benefit from valuation of biological assets. Your pick is from Kakuzi, Kapochuria and Williamson (the latte two are one and the same and I am not sure why they haven't merged). All three have already been noted and have hence been rising steadily. Best time to buy is once they are xd and well before the annual results are announced. I'd normally class Mumias as an agri stock but the power co-generation changes matters somewhat. Pick is Kapchorua, although it'd have been Kakuzi whose operations I'm very familiar with but it has corporate governance issues for days.

Commercial and services sector: Easy one. Safcom. I think it has 30% upside over the next 12 mo0nths. Compe in the mobile telephony market is in disarray once more with Zain up for sale, Orange changing CEOs and Econet, being well, Econet. Interestingly its trying to buy up programming and software capacity. Expect multi-media offerings. And of course, MJ is leader of TEAMS. I won't MPESA as this remains on licence to Vodafone, its parent. AK is now the most expensive share on NSE, otherwise would have been my pick at Ksh20 or lower. ScanGroup will suffer from Zain and others slowing down and general macroeconomic conditions. Pick Safcom.

Finance sector: Equity is till the stand out stock in this sector. It has lead market share at the NSE, will be very competitive in Ug and is expanding into Rwanda and South Sudan. DTB has a similar strategy in TZ especially as does KCB in the same countries as Equity as well as TZ. What distinguishes Equity from the other two is

· Strongly capitalised

· Historically nimble and able to grow from a low base (necessary regionally).

The other banks share to look out for is Stanchart. It has just completed purchase of First Capital (additional fees income loan arranging and any M&A activity) and will mostly certainly benefit from the forthcoming bond glut without any potential downside from bad debt write offs. Added benefit is its high dividend yield.

Industrial and Allied: Sector in a tricky time (fuel costs higher, anaemic export and domestic market). Stocks that will do well have already appreciated or stayed fairly steady during the bearish period. This sector is probably the hardest to gauge. Clearly, its hurting because of the perfect headwind combination of fuel/localised inflation and the macro conditions (anaemic export and domestic demand). Look for utility or utility like operators. But do note that KPLC and KenGen will suffer from the short rains=lower power generation=power rationing spell. So EABL is a utility-like monster with deep pockets and looking to expand regionally. It does look expensive on the basis of the last 9 months though. Maybe EA Cables, but it had issues as early as January. Mumias and co-gen? Maybe, but I have been unconvinced for a long period.

Avoid sector: Olympia should be fairly self-explanatory. I think it might another Uchumi in the making. Except it has no redeeming qualities. KQ, please google Virgin and BA to understand the dire straits this industry is in. I think oil prices will stay at current and lower prices over the next 12 months mainly because of the wider economy.

Wednesday, July 01, 2009

First they came for the poor...

Crime is one facet.

The others are water: in towns, this will of course manifest itself in water rationing in urban areas. Do note however that there are plenty of private water distributors. In rural areas, we have situations building up everywhere. Having grown up around a self-help water project now sadly defunct due to too many disputes, I saw first hand how a community project could easily degenerate to one for himself and to hell with others kind of situation. How about where pastoralists meet subsistence farmers?

Electricity: no rains, no water. As per KenGen's 2008 annual report, 72% of the power it generates is hydrology-based (water to you and me). Very sobering...Especially when we have some much of our economic growth pegged on growing usage of electricity

Land: Say no more. Except as desertification becomes and issue, arable land shrinks. The 60-70% agriculture population is going where.

Tuesday, June 30, 2009

Portolio- 6month retrospective

Monday, June 29, 2009

About the trees- again

When was the last time you planted or encouraged somebody to plant trees.? Why aren't we getting touchy about deforrestation in Mau, Mt Kenya, or the Tana River (and the Qatar) land grab? Or the drying Mara, Uaso Nyiro rivers. Yet we can cry ourselves hoarse BSing about some dead musician/p who won't add sukuma wiki or Kenyan grown maize to our plates. Swine flu which dominates the headlines today has got nothing on the coming drought or fights over land and water. Where is Michuki/Kimendeero when his purposeful leadership is needed?