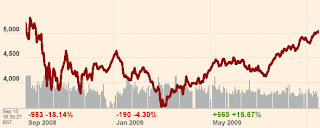

Today 1 year ago was a fairly traumatic day not least for Lehman Brothers folk who turned up to work only to be told no pay no job et al. While there is generally little sympathy for big bank-bursting bonus earning folk getting made redundant, the effects were felt world-wide and are of course still reverberating today with many unit trusts and hedge funds who had or offered clients exposure to Lehman Brothers' structured products suffering.

The main thing though is that tremendous amounts of money and measures such govt stakes in banks and quantitive easing have resuscitated the banking system thus allowing markets to start playing their signalling role. We are far from out of the woods, but all signs are that economies will be able to self-sustain beyond govts exiting from financing banks and economies.

Irony? Well, the preceding bubble was in the main caused by a benign interest rate environment allowing banks to borrow locally at low rates and invest in toxic assets for high returns. And the instrument of choice for allowing economies to recover? Zero interest rates...

No comments:

Post a Comment