- Based on your understanding of the business your entity undertakes, identify the risks it faces.

- Measure these risks in terms of the potential monetary impact on your bank's capital/liquidity and profitability.

- Monitor these risks.

- Set up ways of controlling these risks. To be clear, banks as with other walks of life, will always face risks. Control entails expressing your risk limits/appetite and putting controls in place to keep within the said limits.

All about the Nairobi Stock Exchange, USE, DSE, LUSE, GSE, FTSE & KENYA. (Please see disclaimer at the bottom of the page)

Monday, January 09, 2012

Credit crunch- lessons for Kenyan banks' risk management

Friday, July 08, 2011

Charterhouse gate- Peter Odhiambo another unsung Kenyan hero

Tuesday, April 19, 2011

100% mortgages in Kenya.1st signal of the real estate buble

Tuesday, September 07, 2010

Charterhouse bank - the money-launderer's dream bank

- Money laundering: In any story you read about money laundering in Kenya, one of the best examples you get is that of Crucial properties which held a foreign currency account with Charterhouse bank. The company owned by among others Humphrey Kariuki (Wines of the World; Dalbit Petroleum and I think former proprietor of Green Corner in Nai) was investigated by CBK after it received $25m from either Leichstein or Jersey (depends who you ask). CBK reckoned this was drug money. Charterhouse refused to provide details and the whole thing went to court. The judge allowed Charterhouse to go scot free. In the meantime, the CBK team doing investigations discovered that Charterhouse had like 200 customers with 20,000 accounts. Many lacked basic know-your-customer information, but were clearly opened for the the purpose of layering where you disguise the source of your money by making multiple transactions into different accounts. That money-laundering only became illegal in Kenya this year is neither here nor there. When CBK delved it discovered the following other crimes none which have ever been successfully prosecuted because CB and related players pay well.

- Tax evasion: Charterhouse helped Nakumatt (had a 10% stake in CB), to effectively under-declare it sales which meant that its tax payments to GoK were something like Ksh50m compared to Ksh500m for the smaller Uchumi! Effectively, Nakumatt and associates had not paid taxes amounting to Ksh18bn going by the CBK findings. How? Suppliers were paid into their CB accounts where they would either ship the money abroad or shift into several other accounts within CB. When KRA came, it started chasing the account holders. Those cases are still pending.

- Large exposure breaches: Means nothing to most of us, but most banks that have either been conduits of crime or played with the idea of collapsing always do so because they breach larg exposure requirements. In layman terms, no one customer should more than 25% of a bank's loans or deposits. Reason being, if the customer collapses and goes to heaven tomorrow, the bank will more or less follow (though presumably not to heaven). Nakumatt and associates probably did something like 50% of all CB's business. CB also broke banking rules on lending to employees;

Tuesday, April 06, 2010

What lending rate should we be seeing from Kenyan banks?

- Cost of borrowing: Quite simply, a bank is gets its money from 3 sources in order of quantity; depositors, lenders and shareholders. The lenders will typically charge some internationally priced rate and shareholders are covered below. If you look at a typical Kenyan bank's balance sheet, you'll note that the largest two single items are deposits and loans. While we are can talk about the desirable type of depositor (i.e. raia like you and me who are seen as far more stickier than corporate or other financial entities), the key consideration here is the rate depositors require before they can deposit with a typical Kenyan bank. That is, the rate they lend to the bank. Per CBK, the current average deposit rate is 4.89%; typical savings rate is much lower at 1.81% and finally the interbank rate is 2.17% (its unusual for the interbank rate to be so much lower than the CBK rate in itself a sign of some dysfunctional issues). So Kenyan banks are paying 489 basis points for deposits. They are then not going to charge bank loans at anything less than 4.89% and possibly more if their borrowing from abroad (i) attracted higher interest rates and (ii) is a significant portion of their borrowing. We've overlooked the maturity mismatch issue i.e. the bank is borrowing short (you as a depositor can withdraw your funds at any time) but lending long-term (a bank can't take back its loan tomorrow). So lets say 5.5% to breakeven against cost of borrowing. But is this real cost of borrowing? What about staff costs, administration costs (IT, branches) et al. I'd say add 50bps. Thus arrive at 6%.

- Return on capital: A bank has many stakeholders, but the shareholder is the key one as they can guarantee continuity from a regulatory and financial perspective. The bank's lending rate must therefore reflect the shareholder's desired rate of return on his/er capital to keep their capital with the bank. Straightaway, you'll note that the shareholder wants the regular income in form of dividend and eventually in form of capital gains. A potential shareholder (note not a speculator), will want to keep his/er capital with a bank share for say 2 to 3 years. He/she doesn't know what may happen in those 2/3 years i.e. the risk is high, but at the end of it they'll want a return on the principal and reward in form of gains or income for keeping the cash there. The alternative would be to stick the same cash in a t-bill and earn minimum 8.75% per year with guaranteed principal protection. The bank has to deliver an annual income of no less than 8.75%, guarantee the shareholder's principal by ensuring growth in shareprice and reward the shareholder for sleepless nights. Lets say we are now at 10%.

- Loan quality: In Kenya, a bank historically relied on quality of collateral in form of a clean title deed. Many banks have learned painfully that (a) title deed may not be legit (b) may not mean much if there has to be recourse to the courts where you are asked to form an orderly queue at case number 900,001. Other forms of collateral such as shares; guarantors are costly to enforce. Secondily, the other way you judge the quality of your loan book is to have borrowers that don't already have 5 other loans. In Kenya, its not possible to tell this because credit scoring started this year and of course banks didn't share customer information. The risk of lending and guaranteeing that the loan will not go bad has to be rewarded. Add another 300bps to the 10%. Therefore 13% borrowing rate.

Wednesday, January 13, 2010

Predictions for 2010

Markets:

· NSE will touch a high of 4,200 (the highest until 2012) with KQ, Mumias, Equity, Centum, Stan Chart, Safcom all seeing new highs.

· Gold will touch a high of 1,250 before falling off as inflation fears recede due to rises in interest rates in the 2nd half of the year

· Oil will stay around $80 all year

· Shilling will not go below K120 to the pound but will be much more volatile against the dollar

Economics:

· Kenya’s economy will record 4.1% growth in 2010 driven by agriculture, construction, tourism and “actual” reduction in inflation

· Spain, Greece among others will see credit rating downgrades. UK will only avoid one if Tories/Labour have a clear majority in the May elections

Politics:

· The two mbutas that most of us want to see at the Hague, Ruto and UK won’t be going there

· In keeping with our love of tribalism as a political ideology, various of our elected wabunge will continue alliance building ensuring no repeat of 2008 PEV in 2012

· Tories will win but with a sliver thin majority

Environment

· Mau won’t happen. That is, no mbuta will be evicted without the serious compensation already mooted

Monday, November 23, 2009

Is money-making and Godliness compatable?

Monday, November 09, 2009

Investment banks should be banned from proprietary trading

- A1 who is the broker. She executes buy and sell orders on behalf of Angukia's clients (corporate, high net worthy and raia).

- B1 is Angukia's proprietary trader. He buys and sells various instruments using Angukia's capital.

- Finally C1 is the investment banker. He advises Angukia's corporate clients on mergers, divestitures, acquisitions, financing and capital raising events (such as rights issues).

Wednesday, October 21, 2009

Does universal banking have a future in Kenya?

Wednesday, October 07, 2009

What type of CBK governor does Kenya need?

- Control money supply

- Prudential supervision of the banking/financial system

- Patron governors: These are in effect there to support the economic policies of the government of the day. So they'll adopt monetary policy and in some cases, supervisory policy to the govt's economic policies. As an example, in the US we had Greenspan who in support of credit-based economic growth adopted loose banking regulation (even going along witht the idea of awarding self-regulation to some of the larger ibs). In Kenya, we had men like Kortut who was very supportive of the export intiatives that Pattni had come up with or even Mullei who was able to relax the reserve ratio in 2003 so that banks could lend more. In Nigeria, Chukwuma Soludo presided over the introduction of margin lending which indirectly has brought the Nigerian banking system to needing bail-out.

- Clean-up governors: Patron governors with a few exceptions, always create a mess. Guaranteed. Because their policies are not rooted in the basic functions of a central bank, these types of governors wonder into unfamiliar territory which (a) they don't understand (b) can't not then control. Greenspan was talking about cleaning up the mess created by "irrational exburance", but he really didn't know or understand what he was talking about since the scale of the bailout has been huge. Clean up governors therefore have a thankless task of undoing the work of patron governors. Cheserem did this in Kenya in the mid 90s.

- Independent governors: In effect perform the function of a central bank and are thus usually quite unpopular only surviving due to a change of government. Mervyn King has done this to a certain extent. In Kenya, we are yet to see one but urgently need one.

Friday, October 02, 2009

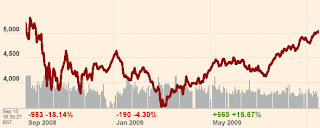

Stockmarkets retrace on the way

After 6 months of almost uninterrupted rise driven by a huge sigh of relief at surviving the largest financial crisis since the South Sea bubble, we may have a retrace shortly. A rise of 60% seems overdone given rising unemployment; budget deficits which suggest that while the economies are recovering, the recovery is not going to be anywhere as fast or as strong as the markets have factored. I therefore expect markets to fall by around 10% in the coming fortnight but thereafter start a slower upward movement as financials start reporting in early November.

Tuesday, September 15, 2009

It was a u/v curve

Today 1 year ago was a fairly traumatic day not least for Lehman Brothers folk who turned up to work only to be told no pay no job et al. While there is generally little sympathy for big bank-bursting bonus earning folk getting made redundant, the effects were felt world-wide and are of course still reverberating today with many unit trusts and hedge funds who had or offered clients exposure to Lehman Brothers' structured products suffering.

Tuesday, September 08, 2009

Aligning bank's size to the economy

After you've

- set required capital ratios

- asked banks to holds capital against every balance sheet

- hold the right type of capital- unencumbered permanent share capital

- request a "will"

- request banks' single counterparty exposure be limited to a multiple of capital

You still won't have tackled the largest elephant in the room so to speak. That is banks that are so large that you don't want them to fail because the cost of rescuing is too prohibitive. Socially, financially, economically locally and maybe even globally, these banks become a threat with economies of scale outweighed by externalities.

Wednesday, July 29, 2009

BRIC nations to provide us with the next bubble

Ever since the credit crunch crunched its way thru investor holdings, many have gone thru

(a) initial state of denial

(b) a renewed determination to avoid equities as an investment vehicle

(c) a reality check as interest rates touched decade lows

d) tentative search for alpha in other markets and initial tentative steps

(e) current deluge of funds flowing into the BRIC countries on hope that their economies will really motor over the next 2/3 years while they await return to normalcy in the US and western economies.

Result-taking China as the prime example? The Shanghai Indices and the proxy Hand Seng have all doubled in value since last September.

So how does that equate to a bubble scenario? Well, the rise is too sudden and when you think that China's main trading partners are US and Japan, is probably not supported by fundamentals. Finally, the monetary/fiscal side of the equation has weighed heavily in favour of a liquidity overhang in the economy.

The other BRIC nations have also seen first snap backs in equity market due to commodity price rise. Are the price rises sustainable?

Monday, July 20, 2009

US and Kenyan Ibanks/Brokers

The only major difference is that the US ibanks and brokers are for most part listed entities. Otherwise the similarities abound:

- · Deal-making: primarily done on connection basis. Its only in the US where the govt could create a system like thru TARF and then get the ibanks to advise , consult and run most of it. GS gets a lot of international type of business because it places its alumni into positions of influence in the US govt. In Kenya, D&B pretty much has gotten all the Kibz era GoK IPOs/OFS. It’s no coincidence since Jimnah cultivated the NARC assiduously and still has close connections with the mishmash GoK

- · Regulatory capture: Regulatory capture is a fancy term for when industry regulators become the dogs that are wagged by the tails they are meant to regulate. Ibanks and brokers set the pace for the regulators in both countries. In good times, ibanks and brokers come up with fancy products and ways of doing things and then ask regulators to regulate them or rivals out of compe. A classic- pal who works with an ibank tells me that in 2007 he approached his his firm’s regulator to get clarification on how the regulator wanted his firm to calculate regulatory capital to be set aside for his firm’s credit default swap business. The regulatory had no clue. Apparently, reporting requirements on SIVs and SPVs were to start this year! At the NSE, CMA has been used to keep compe in or out of the NSE. BBK’s application to list a bond in 2003/4 was refused but agreed to last year when NSE needed the business. Look at the tied agent system being introduced. Its retrogressive in that most countries no longer use it. Its meant to keep out compe given the product is only one-Access to shares at the NSE-

- · No boundaries between business and politics: NSE has remained a protected enclave despite the scandals et al because of its symbiotic relationship with the GoK of the day. Even in the 80s when no Kikuyu business was immune from m-o-1’s pruning ways, the NSE remained intact and reached its highs in the early 90s. Two or three CEos of ibanks/brokers have actually stood as MPs. Eerily, most of the big changes have taken place in an otherwise very friendly environment. Expect this to continue. In the US, it is absolutely no coincidence that Hank Poulson oversaw the decapitation of 3 of the top 5 ibanks during his short stint’s as Treasury Secretary. Goldmans Caschs got $12bn from AIG’s rescue and is the main beneficiary of the demise of its 3 rivals especially in fixed income. Hank Poulson is immediate former CEO...@ Goldman Sachs.

Tuesday, April 28, 2009

Pigs getting in the way... again

Tuesday, April 14, 2009

Think investing in banks is dangerous? Time for a reality check

With a few exceptions, buying bank shares is currently associated with buffoonery in the west after the banks brought us the credit crunch and deepest recession since 19twendia waru (the year we sold potatoes). With hindsight, what has happened in the last 18months should not have come as much of a surprise. That banks don't fail more often is a miracle given the role they play in economies. Banks in essence bear an economy's risk. And because, of this owning a bank's share is a handy way of keeping tabs on an economy's direction.

A conventional bank borrows for short-term and lends for the long-term. When you deposit money in the bank or your employer/contractor pays your salary into your account , a large proportion of it will have left the account by the end of the month. Now a bank working on the old assumption that only 10% of its account holders will access their deposits on daily basis, lends the other 90%. It can lend to credit card holders thus matching monthly spending patterns. More importantly for the economy, it can lend for much longer periods than a month to house buyers, businesses and even to govas. This phenomena of taking short-term deposits and using the same to lend long-term is known as maturity mismatch or transformation.

Even if banks didn't do anything but be conventional, this would make them dangerous and risky.

Wednesday, March 11, 2009

Yo Americano, sort out your banking industry

Reason-everybody over there in the US knows there as an equivalent of the "dead man walking" in the the US banking industry, and thus looking to lock gains made in other markets.

So Americanos, we can all admit "makosa yalifanyika" in the past 5 years, but like the dude who uttered these immortal words, its time for you to take your whipping by accepting to nationalise Citi and Bank of America as a minimum and possibly shut down AIG.

Then we can start looking and defrosting markets for mortgage-backed securities and credit derivatives...

Thursday, February 19, 2009

Bonfus culture replaces bonus culture

So it’s a big deal.

In most places, the no bonus announcements were made the day or week before employees were to find out their pot. Lakini this time, it’s a bit of a perfect storm because there is no golden hallos to move to.

But at least it’s better than the consulting industry where one of the big 4 has actually offered its staff a stark choice between redundancy or 4 day working week and 10-25% pay cut.

PS: The bonfus culture is so-called. Because there is no "F" in bonus. You have to say it quickly.

PPS: As mentioned by somebody previously, the effect of this credit crunch is being felt intensely by minorities. We really must shape up our economies.

Thursday, February 05, 2009

Time for Kenya Financial Regulator is Now

- Chairman: to steer policy, public dissemination and generally be a strong voice for the sector in and out of Kenya. We could start with a current CEO of one of the large banks to give the correct take-off.

- Clear regulation framework and underpining policy that is easily understandable to the financial sector and key stakeholders (investors, business and GoK). This would spell out among others, capital adequacy and liquidity requirements over an economic cycle; reporting requirements; how the firms will be supervised; expactations around management structure and corporate governance; risk management and measurement tools.

- Clearly spelt out targets on consumer education rather than nice sounding words especially around charges; consumer rights and complaints procedures.

- Oversight from the Parliament Committee for Finance