- Retail investors:- despite a drop in inflation, its unlikely that it'll go below double figures before 2012. That means that in real terms, a retail investor will be making a loss from investing a Ksh100k of his in the bond. Although its unusual in Kenya, you may not be able to get the full principal in the first 2 years. It'll be 2017 before you double your money.

- High net worthy: If you have Ksh5m and the risk-aversion of a typical elderly investor, then the 12% is sound return. However, NSe shares pay over 10% in dividend alone.

- Money market fund managers: will love this bond because it make them very competitive against savings accounts.

- KenGen shareholders: interest payment of just over a Ksh1bn will hit the P&L every year. In the first few years, there will be no concomitant revenue from the project to offset this. Something to ponder?

- Electricity consumers: should hopefully see fewer rationing episodes.

All about the Nairobi Stock Exchange, USE, DSE, LUSE, GSE, FTSE & KENYA. (Please see disclaimer at the bottom of the page)

Monday, September 28, 2009

The KenGen Ksh15bn bond beneficiaries

Living abroad: When in Rome...?

- we like our drink and driving. In most of the western countries, this is a huge no no and is a deportable offence. I've lost count

- The law is the law. Lots of black and white situations (i.e. no room for your interpretation) across the bureaucracy.

- Lack of papers means many of us do a lot of underground/menial jobs with no bank accounts and the like.

- Strong motherland bias in investing.

- Loneliness- no weekend relas or easygoing friends...Race is an issue

- Living costs are 4 times higher than Nai in some cities abroad

- Family life is not easy. No mboch or you get expensive childcare. Discipline your kids at your own risk.

- Relas in the motherland expect instant returns adding to the stress.

- Failure to appreciate social situations especially awkward pc ones.

- A significant proportion of our students never complete because of economic situations-note that in some countries students are only allowed to work for given number of hours e.g. 16 per week in the UK.

- Cramped or unhealthy accommodation.

- and the worst, getting ripped off by relas when you entrust them to look after your ventures in the motherland.

- And expecting the law to be on your side in the motherland...

- If you are a prospective student, think not about what your mate is doing but what is your calling. That way, you will be able to endure.

- If you are a student, aim high because lecturers and tutors can be your best reference for jobs in your study nation. Some countries are now giving students 1 yr job visas. Its an awesome situation to make yourself indispensable to your employer.

- If there is a job opening, stay out of office politics, pray your boss gives you the portfolio your qualification deserves and work hard like a Kenyan. You'll shine.

- If you are here for a visit/a few £s, learn what can jobs pay with minimum farce and supervision.

- The west is an individualistic society. Take the opportunity to build and discover you.

- If you can get married and appreciate the cost and difficulties of bringing up your kids here, do so especially if you are a guy. Otherwise, the pubs are waiting to drink your sweat.

Monday, September 21, 2009

KACC: Prevent, Convict & Recover Assets vs Corruption

While many have focused on the kibz illegality (in spirit and law) in re-appointing Ringera, we've overlooked the criteria by which we should evaluate his tenure and KACC's in general. On this criteria, KACC either be closed or revamped as something completely different. Summarising KACC's functions leaves with3 core ones against which you can evaluate its success

- Prevention: by educating; campaigns; facilitating whistleblowing; following up and taking forward credible complaints of corruption. And probably the easiest, using the public wealth declaration forms to pursue GoK employees. Corruption is far worse now than it was in 2003 when KACC came into being. I know and I'm sure others know many who went to parliament in 2002 as paupers and are fabulously rich today. Murungaru is an example. He was facing an auction in October 2002, but today he is... So where is KACC?

- Convicting of the corrupt: This is more the role of the Ag and DPP, but do note that KACC has to present fool-proof evidence of corruption. Crucially, note that KACC can institute civil proceedings where it has evidence that taxpayers money has gone missing via corrupt actions. On either fronts, it has not done so. Even it has presented evidence, I believe only Margaret Gachara has ever been convicted of corruption and even in her case, KACC never went ahead to recover assets.

- Recover of Assets: Biggest failure in my books. From Goldenberg, Ndung'u commission, Anglo-Leasing there has been evidence that taxpayers money was diverted to private pockets. I believe Ksh78bn was mentioned for Goldenberg alone. Ksh4bn that it has recovered is probably what KACC has spent since 2003.

On the above criteria, its fairly obvious that KACC has failed and we need to move on...

Wednesday, September 16, 2009

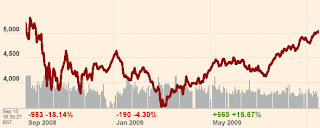

NSE: where is hope?

Tuesday, September 15, 2009

It was a u/v curve

Today 1 year ago was a fairly traumatic day not least for Lehman Brothers folk who turned up to work only to be told no pay no job et al. While there is generally little sympathy for big bank-bursting bonus earning folk getting made redundant, the effects were felt world-wide and are of course still reverberating today with many unit trusts and hedge funds who had or offered clients exposure to Lehman Brothers' structured products suffering.

Tuesday, September 08, 2009

Aligning bank's size to the economy

After you've

- set required capital ratios

- asked banks to holds capital against every balance sheet

- hold the right type of capital- unencumbered permanent share capital

- request a "will"

- request banks' single counterparty exposure be limited to a multiple of capital

You still won't have tackled the largest elephant in the room so to speak. That is banks that are so large that you don't want them to fail because the cost of rescuing is too prohibitive. Socially, financially, economically locally and maybe even globally, these banks become a threat with economies of scale outweighed by externalities.

Thursday, September 03, 2009

Kenya's population growth: time for the China solution?

We are poor nation in money terms.

- Kenya's population stands at around 40mn having doubled over the last 25 years.

- It’s growing at 2% per year which means it is on schedule to double in 2050.

- In real terms, our GDP has stood still since 1995 in real terms (that is 2002-2006 was merely to get us on even keel with 1997 and before and years since have been eroded by double-digit inflation). The economy as its structured currently can't double in that period.

- 65% of our population ekes a living from agriculture. Though this percentage will decrease in term, the total rural population will still account for around 50% by 2050

- Only 8% of Kenya's land is arable

- Without a sharp reversal, the current environmental degradation coupled with land issues, may well reduce this proportion of arable land to around 6%.

China was faced with similar circumstances in early 70s, its population having doubled within a period of 30years and with a static economy and agriculture growth. It worked what was its optimal carrying capacity based on its ability to feed its people (given arable land, land and economy growth potential) and instituted what is today known as the "one-child". It was actually more nuanced than that i.e. the one-child policy only applied to urban cities and didn't explicitly preclude having more than one child.

Is the population control needed for Kenya? Well, going above, a definitive yes. Is a China-type policy practical? Yes, GoK would offer to educate one child for free all the way to secondary school provided the parent/s only had the one. The parents would then have to pay for any additional ones.

Credit where its due: Kenya High Comm (UK)

At the Kenya High Commission in the UK, I believe as a Kenyan that you can experience how good Kenyan civil servants can be at delivering. A new passport application will typically take around 5 weeks. There is actually faster that it'd to get a British passport, but is also a smoother process. That is, you go online and print out the application form, you're told what other documents you need; how much it'll cost you and which mode of payment is acceptable. If you submit at their office, you'll get the option of the new passport being posted back to you or you get a phone call when it is ready to pick up and you just go there between 2-330pm. And that’s that. While at the London office, you'll get a pick of glossy magazines such one from Magical Kenya. I usually take away copy and give to colleagues and one or two have booked safari tours on that basis. A word though about the Kisumu2007 glossy. On the face of it, it has the GoK emblem, but has clearly been done by some of those NGOs to justify their extravagant lifestyles in Kenya. Some quotes "the Nai to Kcity road is a good example of the many complaints about neglect of roads in certain areas". And they are trying to market Kisumu!

The High Comm has also involved itself with nrks in the UK to a very high degree, attending most events that with a Kenyan theme. Unusually, its website is updated regularly.

All in all, Kenya High Comm gets my vote for civil servants we can be proud of.